Exploring Student Debt: THECB's 60x30TX goals

For followers of higher education trends, stories detailing the student loan debt crisis is nothing new. With 45 million borrowers owing nearly $1.7 trillion in student loan debt as of 2021, and with President Biden extending the federal student loan repayment freeze through May 1, 2022, the topic of student debt is top-of-mind for many as we enter the third calendar year under the cloud of COVID-19. It is against this backdrop that we are starting a new series where we will be exploring student loan debt from a variety of perspectives, beginning with a look at data within the state of Texas.

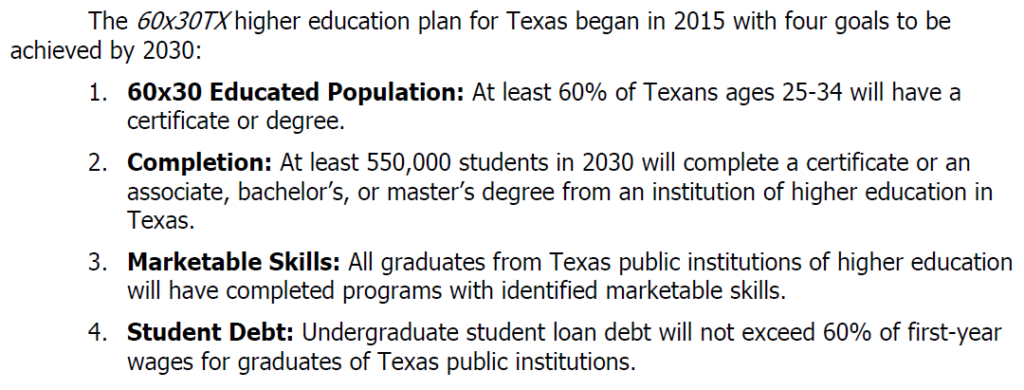

THECB's 60x30TX Plan

Introduced in 2015, the Texas Higher Education Coordinating Board’s (THECB) 60x30TX Plan established a series of goals for the state’s public colleges and universities to be achieved by 2030. As can be seen in the image to the right, the four 60x30TX goals range from an educated population to student debt. For the purpose of this blog series, we will be concentrating on Goal 4: Student Debt.

The Debt Reality for Bachelor's Degree Graduates from Public Universities in Texas

While the goal statement addresses one aspect of student debt, namely a 60-percent ratio of student loan debt to first-year wages, the THECB also tracks other metrics, which we explore below. In general, the data show that statewide measures related to student loan debt have improved since the introduction of the 60x30TX goals.

Percentage of Students Graduating with Student Debt

- Based on the visualization below under Grads w/ Debt: Statewide, the statewide average has improved year-over-year from 2014 to 2020, dropping from 62.5% to 56.4% during that timespan.

- Even with the 6.1 percentage point decrease, the count of students graduating with debt has increased. In 2014, there were almost 94,000 bachelor’s degrees awarded by public universities in Texas. That number increased to over 117,000 in 2020. Based on the percentages with debt at graduation, approximately 8,000 more bachelor’s graduates completed their degree with debt in 2020 when compared to 2014.

- In 2020, the UT System had the lowest percentage of bachelor’s graduates with student loan debt at 52.2%, while the Texas State University System had the highest percentage at 63.1% for public university systems with more than one institution.

- Trends comparing 2014 to 2020 (Grads w/ Debt: 2014 vs 2020) show that all of the public university systems improved by at least 3.8 percentage points.

Median Student Loan Debt of Graduates

- For bachelor’s graduates with student loan debt (Median Debt: Statewide visualization below), the statewide median debt amount dropped from $26,564 per graduate in 2014 to $25,207 in 2020. This drop of $1,357 represents a 5.1-percent decrease in median student loan debt statewide.

- Across public university systems, the Texas State University System saw the largest improvement for systems with more than one institution with a drop of over $3,400 per graduate with student loan debt (Median Debt: Systems 2014 vs 2020), thanks largely to Lamar University’s more than $14,000 decrease in median student loan debt (Median Debt: Univs 2014 vs 2020).

- The Texas Tech University System was the only system that experienced an increase in median student loan debt of $1,450 from 2014 to 2020, as Texas Tech University saw an increase of almost $2,500 in median student loan debt.

- University-level trend data can be viewed by clicking on the Median Debt: Universities tab at the far right.

So What?

The good news regarding student loan debt at Texas public universities is that a number of metrics are trending in the right direction: the percentage of students graduating with a bachelor’s degree and with student loan debt is decreasing, as is the median student loan debt of graduates. As stated above, though, additional contextual factors provide a more full understanding of the challenges faced in terms of student loan debt. For instance, even though a smaller percentage of students are graduating with student loan debt, the fact that more degrees were awarded in 2020 when compared to 2014 means there are actually more students graduating with debt than before. Throughout the course of this blog series, we will be looking at various data points with the goal of contributing to the broader understanding of the multi-faceted nature of student loan debt.

One Comment

It may not be within the scope of this research project, but it would also be noteworthy to understand how long these graduates are carrying their debt. This relates to the 4th 60×30 goal – though, perhaps not directly – since the 60%/first year wages debt target was clearly established to ensure the debt would be manageable (i.e., could be paid off in a reasonable period).

Comments are closed.